February 2024 - Are Procurement KPI's & Performance Metrics Changing?

February 2024 - Are Procurement KPI's & Performance Metrics Changing?

In January, 1st Executive Ltd engaged with our network of Global CPO’s, Procurement Directors and Supply Chain Directors to investigate how Procurement is being measured, and how success is viewed in the eyes of key stakeholders given the evolving landscape of increased inflation, Sustainability targets and rising cost of goods.

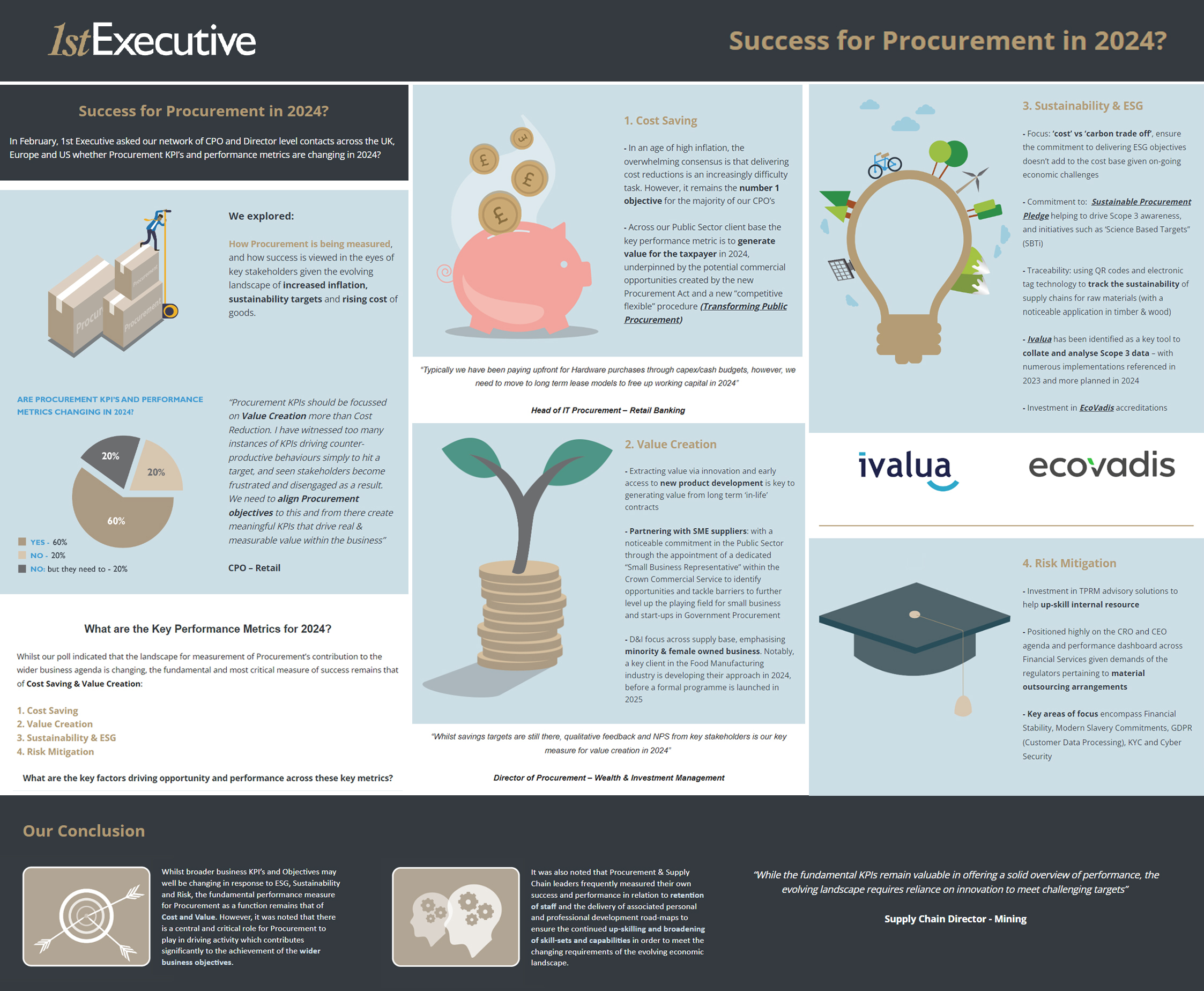

We asked our network of CPO and Director level contacts across the UK, Europe and US whether Procurement KPI’s and performance metrics are changing in 2024?

Are Procurement KPI’s and Performance Metrics changing in 2024?

Yes = 60%

No = 20%

No, but they need to = 20%

“Procurement KPIs should be focussed on Value Creation more than Cost Reduction. In the past, I have witnessed too many instances of KPIs driving counter-productive behaviours simply to hit a target, and seen stakeholders become frustrated and disengaged as a result. The client remains at the centre of organisational strategy, so we need to align Procurement objectives to this and from there create meaningful KPIs that drive real & measurable value within the business” CPO – Retail

What are the Key Performance Metrics for 2024?

Whilst our poll indicated that the landscape for measurement of Procurement’s contribution to the wider business agenda is changing, the fundamental and most critical measure of success remains that of Cost Saving & Value Creation:

Cost Saving

Value Creation

Sustainability & ESG

Risk Mitigation

What are the key factors driving opportunity and performance across these key metrics?

Cost Savings:

In an age of high inflation, the overwhelming consensus is that delivering cost reductions is an increasingly difficulty task. However, it remains the number 1 objective for the majority of our CPO’s.

Across our Public Sector client base the key performance metric is to generate value for the taxpayer in 2024, underpinned by the potential commercial opportunities created by the new Procurement Act and a new “competitive flexible” procedure (Transforming Public Procurement)

“Typically we have been paying upfront for Hardware purchases through capex/cash budgets, however, we need to move to long term lease models to free up working capital in 2024” Head of IT Procurement – Retail Banking

Value Creation:

Extracting value via innovation and early access to new product development is key to generating value from long term ‘in-life’ contracts

Partnering with SME suppliers is high on the list of priorities – with a noticeable commitment in the Public Sector through the appointment of a dedicated “Small Business Representative” within the Crown Commercial Service to identify opportunities and tackle barriers to further level up the playing field for small business and start-ups in Government Procurement

D&I focus across supply base with a focus in minority owned & female owned business. Notably, a key client in the Food Manufacturing industry is developing their approach in 2024, before a formal programme is launched in 2025

“Whilst savings targets are still there, qualitative feedback and NPS from key stakeholders is our key measure for value creation in 2024” Director of Procurement – Wealth & Investment Management

Sustainability & ESG:

Big focus on the ‘cost’ vs ‘carbon trade off’, ensuring that the commitment to delivering ESG objectives doesn’t add to the cost base given on-going economic challenges

Commitment to the principles of the “Sustainable Procurement Pledge” (spp.earth) –helping to drive Scope 3 awareness, and initiatives such as ‘Science Based Targets” (SBTi)

“Traceability” – using QR codes and electronic tag technology to track the sustainability of supply chains for raw materials (with a noticeable application in timber & wood)

Ivalua (Ivalua) has been identified as a key tool to collate and analyse Scope 3 data – with numerous implementations referenced in 2023 and more planned in 2024

Investment in EcoVadis (EcoVadis) accreditations

Risk Mitigation:

Positioned highly on the CRO and CEO agenda and performance dashboard across Financial Services given demands of the regulators pertaining to material outsourcing arrangements

Key areas of focus encompass Financial Stability, Modern Slavery Commitments, GDPR (Customer Data Processing), KYC and Cyber Security

Investment in TPRM advisory solutions to help up-skill internal resource

Our Conclusion:

In summary, our conversations in January highlighted that whilst broader business KPI’s and Objectives may well be changing in response to ESG, Sustainability, Risk the fundamental performance measure for Procurement as a function remains that of Cost and Value. However, it was noted that there is central and critical role for Procurement to play in driving activity which contributes significantly to the achievement of the wider business objectives.

It was also noted that Procurement & Supply Chain leaders frequently measured their own success and performance in relation to retention of staff and the delivery of associated personal and professional development road-maps to ensure the continued up-skilling and broadening of skill-sets and capabilities in order to meet the changing requirements of the evolving economic landscape.

“While the fundamental KPIs remain valuable in offering a solid overview of performance, the evolving landscape requires reliance on innovation to meet challenging targets” Supply Chain Director - Mining

If you'd like to contribute to our topic for March 2024 - please reach out to Richard Shelley or Sally Davis, we'd love to hear from you!